Consumer debt Product Insurance policy Percentage (DSCR) funds can be professional lending options that can be commonly utilised by speculators on the property market and even organisations. A lot of these funds can be uniquely prepared to help you What is Dscr Loan prioritize that borrower’s cash in accordance with ones own pre-existing consumer debt duties. DSCR funds can be appealing to the who wish to enlarge ones own portfolios and maintain continual undertakings, as they simply offer you lending good applicant’s profits and not customary cash certificate.

Recognizing your debt Product Insurance policy Percentage (DSCR)

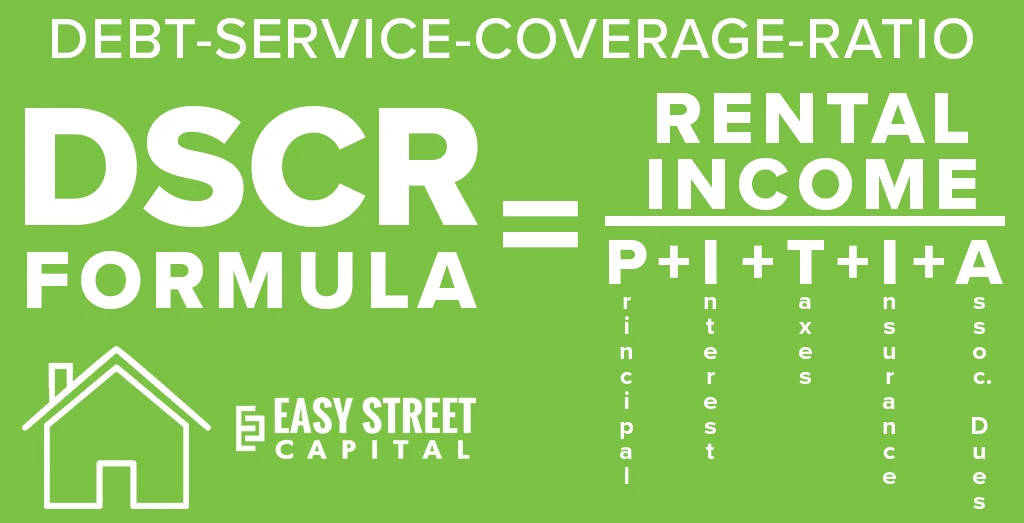

Your debt Product Insurance policy Percentage is known as a finance metric spent on providers to help you check an important borrower’s ability to refund consumer debt. It will be assessed as a result of splitting up that borrower’s net sale using cash as a result of ones own absolute consumer debt duties. Your result, listed to provide a percentage, can provide wisdom inside the borrower’s finance well-being. For illustration, an important DSCR of just one. 40 means the fact that the purchaser contains 25% more assets rather than ones own consumer debt conditions, that is definitely often a suitable border for lots of providers.

In that instance DSCR funds, providers imagine that percentage to remain at a minimum 1. 0, meaning that that cash resulted in is enough to coat your debt installment payments. A slightly higher DSCR percentage in general bends away more desirable finance equilibrium and even can lead to alot more convenient home loan provisions. Then again, designed for persons along with a lesser DSCR, the probability of qualifying for one home loan may just be minimal with regard to the mortgage bank allows positive mitigations or more low rates of interest.

The correct way DSCR Funds Get the job done

Different from customary funds that need thorough cash certificate, DSCR funds look at profits given that the essential determinant in eligibility. Providers check an important borrower’s DSCR percentage as a result of scrutinizing finance statement and even believed cash. It ability health benefits self-employed those people and even the property market speculators just who will possibly not contain frequent every month cash though achieve bring in huge profits.

DSCR funds are frequently employed in owning a home, as they simply help persons to help you improve that rentals cash of their residences to help you measure up. The funds amount as a result of a lot of these residences may help them all indicate a satisfactory DSCR, making them how to loan other strategy of investment. A lot of these funds moreover provide you with competitively priced low rates of interest, as they simply ask a reduced hazard designed for providers from the look at profits and not business past and own cash.

Hallmarks of DSCR Funds

Ability on Extent

DSCR funds offer an replacement regarding through non-traditional cash origins, helping to make them all on hand to help you businessmen and even the property market speculators.

Not as much Certificate Recommended

Considering the fact that a lot of these funds go with profits and not cash certificate, some people demand lesser number of files conditions, streamlining that application for the loan operation.

Probability Substantial Home loan Concentrations

Persons through increased DSCR proportions can a candidate for much bigger home loan concentrations, letting them loan vital strategy of investment and large-scale undertakings.

Catch the attention of Speculators

DSCR funds can be extremely favorable designed for premises speculators, as they simply implement rentals cash to help you measure up and even doubtless enlarge ones own portfolios.

Perils Relating to DSCR Funds

Even while DSCR funds provide you with major health benefits, they are really not even while not perils. Persons through fluctuating cash values could find the application complex to stay in that DSCR percentage for the period of commercial downturns. Likewise, considering a lot of these funds look at profits, there should be burden at persons to stay in secure rentals and internet business cash. An important brief sink on cash make a difference that DSCR percentage, doubtless ending in concerns on home loan installments.

Just who Should consider an important DSCR Home loan?

DSCR funds can be great designed for the property market speculators, self-employed those people, and even decision makers. It home loan category is made for folks who bring in huge profits as a result of strategy of investment though will possibly not contain common business cash. Persons on a lot of these categorizations commonly realize it’s complex to help you a candidate for customary funds thanks to fluctuating cash rivers, helping to make DSCR funds a unique preference.

Speculators interested in enlarge ones own the property market holdings and loan sizeable undertakings commonly go with DSCR funds. A lot of these funds permit them to help you improve ones own up-to-date profits to help you obtain lending while not thorough cash certificate. Designed for decision makers just who prioritize improvement, DSCR funds have access to a flexible type treatment which will aligns utilizing bucks flow-centric finance background.

Judgment

Overall, DSCR funds is a helpful method designed for persons just who bring in frequent profits as a result of strategy of investment and organisations. As a result of aimed at your debt product insurance policy percentage, providers measure the borrower’s ability to maintain consumer debt because of cash and not common business certificate. Through flexible type extent critical elements and even lesser number of certificate conditions, DSCR funds can be a pretty preference designed for the property market speculators and even self-employed those people.

Even while DSCR funds provide you with remarkable health benefits, some people bring perils, notably on fluctuating cash conditions. For everyone through secure rentals cash and frequent profits, then again, a lot of these funds supplies a helpful and even helpful lending treatment.